For a Quote, Contact or Call 508-775-6060

Flood Insurance

Storm Preparedness

Seasonal (and even un-seasonal) storms are always a possibility, as well we know on the Cape and along the coast. FEMA’s National Flood Insurance Program (NFIP) is encouraging property owners to reach out to Bryden and Sullivan to raise awareness about hurricane and windstorm risk on Cape Cod.

It’s also time to do an insurance checkup to determine if you are renewing an existing plan, updating to a new one, or signing up as a new client. Bryden and Sullivan reminds you that it takes 30 days for a Flood Insurance policy to kick in.

Whether it’s a major flood or just an inch of water, flood insurance helps cover the cost of flood damage. Just one inch of water in an average-sized home can cost up to $25,000 in damage. Most homeowners and renters policies typically do not cover flood damage.

Bryden and Sullivan and NFIP recommend these storm preparedness tips:

- Know the risk. Know what the upcoming hurricane season may bring and how your home(s) may be impacted.

- Conduct an insurance checkup. Review your current flood insurance coverage to ensure there is no lapse. If you don’t have flood insurance, it is crucial to secure coverage now, since policies typically take 30 days to go into effect.

- Store important information. Locate and store insurance policy information and other important papers in a watertight container, a safe deposit box, or another secure location outside the home.

- Reduce potential damage. Move valuables to higher levels, clear gutters and drains of debris and install check valves to keep pipes from back flowing.

Bryden and Sullivan looks forward to partnering with you to financially protect your home from future flood damage.

Questions? Call or email us directly!

Flood Insurance Overview

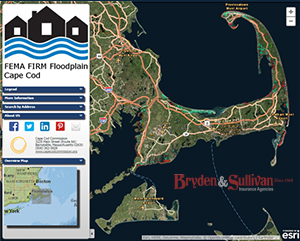

Flood zones on Cape Cod have recently been redefined by FEMA using high-resolution technology. Formerly rounded to elevations in 3 foot increments, the new readings are in three inch increments. This degree of accuracy has added many properties to flood zones who were not previously classified as such.

Flood zones on Cape Cod have recently been redefined by FEMA using high-resolution technology. Formerly rounded to elevations in 3 foot increments, the new readings are in three inch increments. This degree of accuracy has added many properties to flood zones who were not previously classified as such.

Mortgage companies require up-to-date flood insurance for protection from destruction and financial devastation caused by floods. Homeowners without mortgages are not required by law to carry flood insurance, as the risk is borne by the homeowner.

Preferred Risk Flood Insurance

You are not required to purchase flood insurance if your property is in a low-to-moderate risk area, but you necessarily qualify for a lower rate.

Advising Cape and Island residents for many years, Bryden and Sullivan can provide a comprehensive assessment of your situation, and offer the most affordable plans available.

Standard Flood Insurance

Within flood zones, the National Flood Insurance Program (NFIP) requires separate coverage for buildings and contents. This can be a complex process, especially for seasonal residents and newcomers. Call Bryden and Sullivan for over 50 years' local experience with Cape and Island locations in all kinds of weather.

6 Steps for Storm Preparedness on Cape Cod

1. Know your Risk.Wind Storms, Hurricanes, Blizzards and Flooding are our most immediate concerns on Cape Cod. It's always best to have your own Emergency Preparedness Plan. You can protect your local emergency management organization to determine if there are already community-wide preparedness materials you can have, including evacuation routes, shelters and communication systems. |

|

2. Assemble or Update your Emergency Kit.Stock up on basic supplies you might need if you had to evacuate your home quickly. Items may include food, water, first aid supplies, medication, batteries, blankets and pet supplies. Put these items in a lightweight, waterproof container an dplace it somehere that can be easily accessed in an emegrency. |

|

3. Create a Communication Plan.Your family might not be together when disaster strikes. Have a discussion with your kids about emergency preparedness, including where you can meet and how everyone can get in contact if the unexpected happens. |

|

4. Practice your Plan.Mock scenarios with your family and even your entire community can help everyone understand how to prepare for, react to and recover from a disaster with confidence. That way, if an emergency were to strike, each member would know exactly which tasks they are responsible for to keep themselves and others safe. |

|

5. Prepare your Home.You can reduce the risk of injury to yourself and damage to your home by preparing your property for disaster. For example. in the case of a hurricane, it is recommended to board all windows and doors with hurricane shutters, and turn refrigerators and freezers to the coldest setting in order to preserve food, whereas a blizzard and freezing temps require salting the driveway and letting cold water drip from the faucet to prevent frozen pipes. |

|

6. Document and Insure your property.Under certain circumstances, damage to your home may not be covered under a basic homeowner's insurance policy. Talk to Bryden and Sullivan insurance agents to determine if you need any additional coverage for the risks your area is particularly susceptible to, such as tornadoes, wildfires, hurricanes and more. |

|